Driving Efficiency with SaaS-Based Agentic AI in Fund Operations

| Industry | Asset Management, FinTech, AI-Powered Operations |

| Features | Domain AI agents (analysis, support); automated document ingestion; semantic retrieval; investor report auto-generation; HITL approvals |

| Technologies | React, TypeScript, Java Spring Boot, Python, OpenAI GPT‑4o, in-house finetunes |

| Infrastructure | Multi-cloud (AWS, Azure, GCP); observability with Datadog |

Client Profile:

A digital-native asset management firm dealing with large volumes of fund performance data, investor reports, regulatory documents, and customer support operations. The client needed scalable AI solutions to reduce manual processing and accelerate decision cycles. To meet this need, we implemented SaaS-Based Agentic AI in Fund Operations as the core approach, positioning Generative AI for Asset Managers as the central nervous system for modern fund operations. This shows how Asset Management Workflows with AI-Powered Automation can be practically implemented to scale those operations.

Challenges:

- Time-intensive document review (fund docs, regulatory reports)

- Inconsistent knowledge management across teams

- Slow portfolio analysis due to fragmented data sources

- High support costs, low CX consistency

- Developer context-switching and knowledge silos

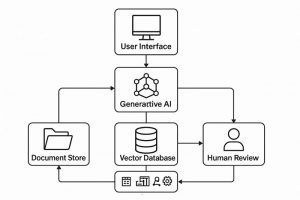

Technical Solution:

- Deployed a Workspace as the central AI hub to enable SaaS AI for asset management and streamline end-to-end fund management workflows.

- Configured AI Agents with role-specific tools (e.g., fund analysis, client support) so analysts can call domain agents for quick insights—an Agentic AI for fund operations capability that reduces turnaround time.

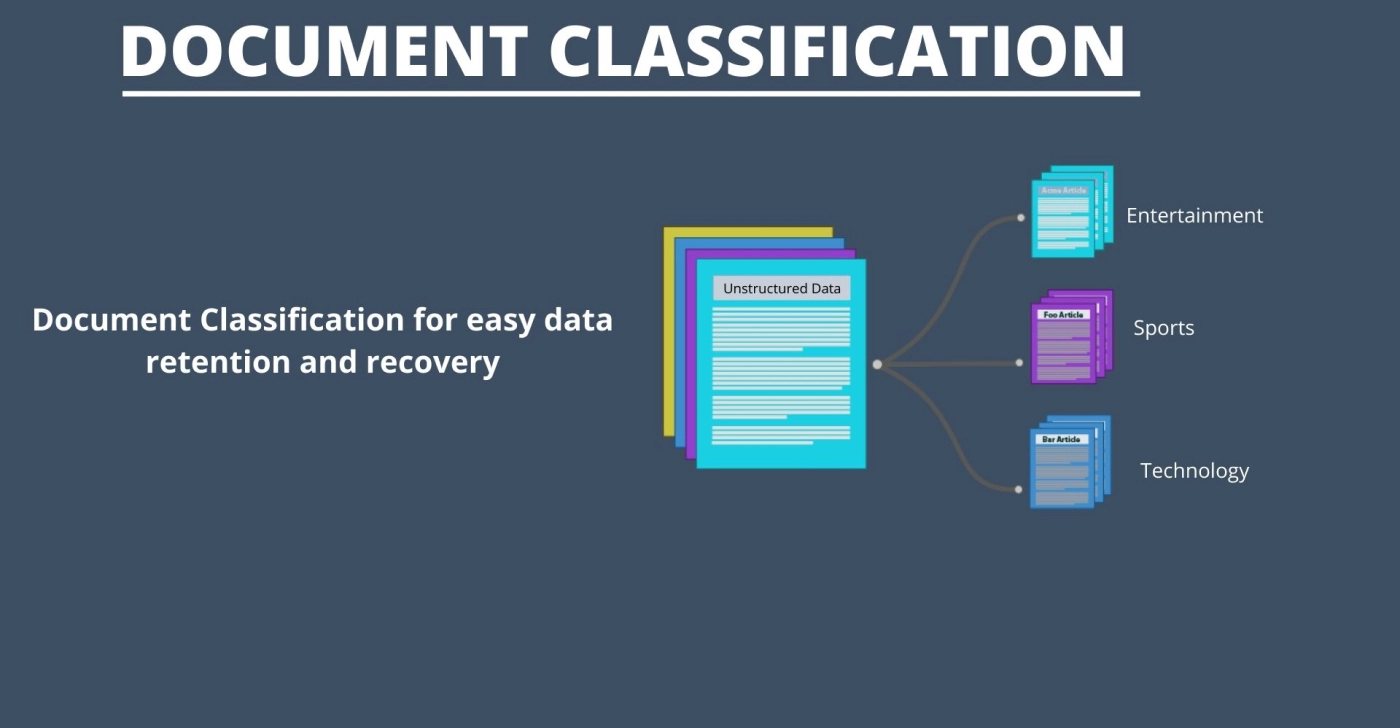

- Built custom document extraction templates for key regulatory forms and fund data to automate ingestion and reduce manual errors.

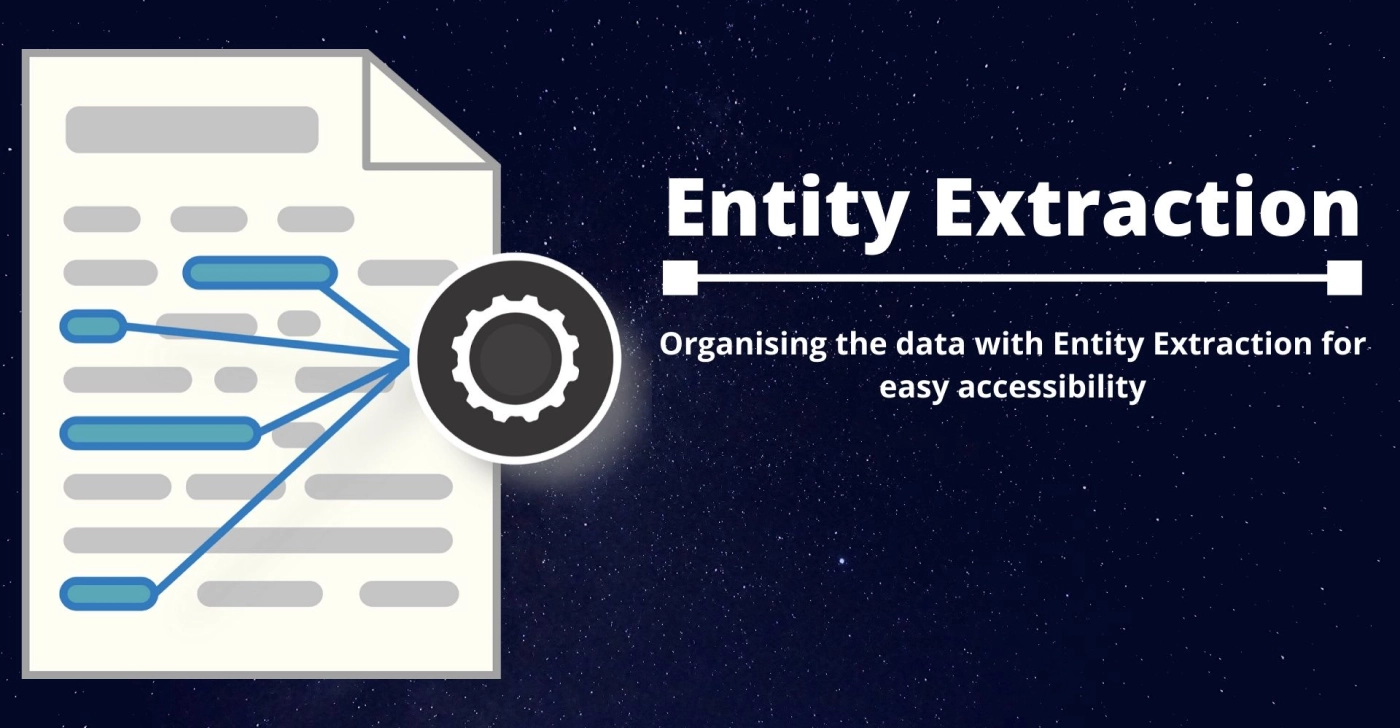

- Integrated internal databases, CRMs, and cloud drives with semantic search and vector indexes to power rapid retrieval and enable AI-powered portfolio analytics.

- Implemented human-in-the-loop workflows to ensure compliance and accuracy on sensitive outputs.

- Enabled report auto-generation using a writer tool for investor summaries and analytics, reducing repetitive writing tasks and improving consistency.

- Standardized playbooks that operationalize Generative AI for Asset Managers across analysis, reporting, and support.

Technology Stack:

- Frontend: React, TypeScript

- Backend: Java Spring Boot, Python (for AI integrations)

- AI Models: OpenAI GPT‑4o, in-house finetunes

- DB: PostgreSQL, Pinecone, Weaviate (Vector DB)

- Infra: AWS / Azure / GCP

- Tools: Slack, GitHub, Datadog, Confluence

Architecture Diagram:

Results / Business Benefits:

- Reduced fund document review time by 70%

- Lowered support handling time by 45%

- 30% productivity boost across ops and support teams

- Accelerated decision-making: from weeks to hours

- Improved compliance tracking and audit readiness

- Increased CSAT by 35% via personalized AI + human-in-the-loop support

Conclusion:

The AI Answer Engine transformed the client’s investment operations by enabling real-time document insights, enhancing CX, and boosting internal efficiency. By integrating custom AI agents, secure knowledge repositories, and automated investor reporting, asset managers were empowered to act faster, remain compliant, and focus on high-value strategy rather than repetitive tasks. This case demonstrates Generative AI for Asset Managers in practice, proving how Agentic AI for fund operations and SaaS AI for asset management combine to deliver measurable business impact.

Credit: –

Hammad Yasub Khan

Full Stack Developer