| Industry | FinTech, Banking, Financial services |

| Features / Functionalities | Hybrid Application development, Database Management, Data Capture & Integration, API Integrations, Messaging and Communication, Caching, Reporting, Database Schema Management |

| Technologies | Flutter, Dart, Spring Boot, Java, JPA, Hibernate, Postgresql, Redis. |

| Infrastructure | AWS ECS for running the service, AWS ECR for docker image, RDS Postgres for Database, Docker for containerisation |

Introduction

Our product is a multi-level data capture and integration solution designed for the FinTech sector to streamline lead generation and data management. At its core is a cross-platform FinTech application development approach using Flutter and Dart, ensuring seamless and consistent experiences across devices. This hybrid mobile app serves as a powerful FinTech mobile application development platform enabling easy access to various financial services.

Client Profile

The client aims to promote financial inclusion by providing banking and financial services to rural and unbanked communities.

Technology-driven client, bridging the gap between traditional banking and rural, underserved populations by the use of technological solutions, such as mobile banking and fintech developments.

Their website or mobile app can be used to access and administer a variety of digital banking services, such as loans, savings accounts, and other financial products. By facilitating access to credit, savings, and financial education, they concentrate on improving the financial health of individuals and communities.

Challenges

- Integrating multiple services, including OCR, Credit Score, and eSign APIs, along with COS backend.

- Managing data consistency across different services and ensuring that data is correctly synchronized.

- Handling a growing volume of data and users while maintaining performance and responsiveness.

- Integrating sensitive data, such as credit scores and eSignatures,

- Managing the disruptions or downtime from External Services

- Ensure low-latency communication, especially in real-time scenarios

- Creating a smooth and user-friendly experience for users during multi-level lead-capturing process

- Developing a thorough testing and quality assurance processes due to high complexity of the solution.

- Documentation and effective maintenance of the solution for future references.

Technical Solution

A variety of cutting-edge technologies and tactics are combined in this precisely planned technological solution to provide a scalable, reliable system for multi-level lead capture and data management.

- Application Development

– Our hybrid application was meticulously crafted using the Flutter framework.

– We ensured cross-platform compatibility and seamless user experience. - Backend Architecture

– The robust backend relies on Java Spring Boot APIs, backed by a PostgreSQL database, ensuring data integrity and reliability. - Integration and Data Flow

– We’ve seamlessly integrated our COS (Content Object Storage) backend with various external services, enabling efficient data exchange.

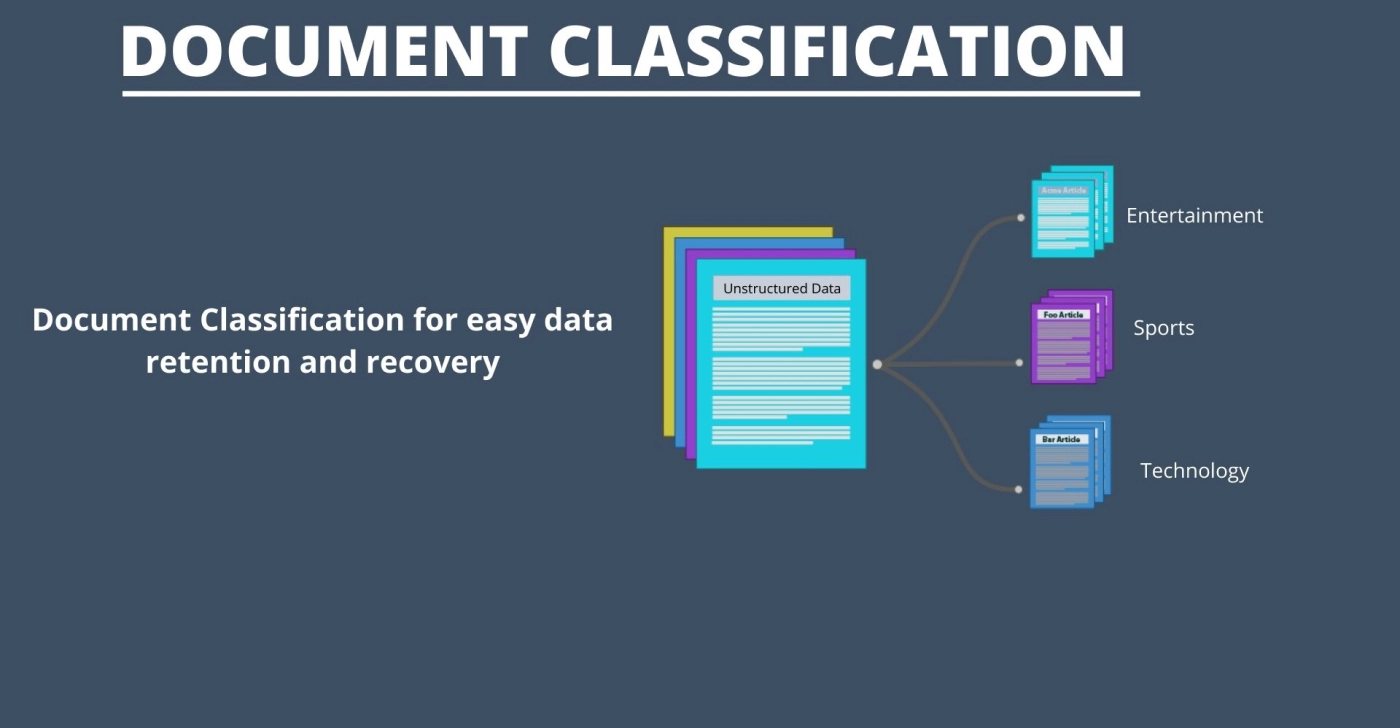

– This includes the implementation of OCR APIs, Credit Score APIs, and eSign APIs, enriching our data and services ecosystem. - Data Capture and Processing

– Data capture system that operates at every step of the user journey.

– This ensures a holistic approach to data acquisition and utilization. - Communication and Event Handling

– To foster efficient communication with external services, we’ve leveraged a pub/sub (publish/subscribe) and webhook mechanism. - Caching and Scalability

– Redis serves as our pub/sub messaging system, enhancing data caching and distribution, which is vital for scalability and reducing latency. - Reporting and Data Visualization

– Jasper, is harnessed for generating polished PDF reports, providing valuable insights to stakeholders. - Database Management

– For seamless schema migration tracking and version control, Liquibase is employed, ensuring database stability and consistency.

Technical Stack

– Technologies : Flutter, Dart, Spring Boot, Java, JPA, Hibernate, Postgresql, Redis

– Infrastructure : AWS ECS for running the service, AWS ECR for docker image, RDS Postgres for Database, Docker for containerisation

Results/Business Benefits

Overall, the solution empowers the business with the tools and capabilities to stay competitive, make data-driven decisions, and enhance customer satisfaction through efficient operations.

- Seamless Data Integration

- Comprehensive Lead Capture

- Enhanced Data Quality

- Real-time Communication

- Scalability and Performance.

- Custom Reporting

- Database Management

- Cost Optimization

- Competitive Advantage

Conclusion

This multi-level data capture and integration solution coupled with cross-platform FinTech application development represents a forward-looking approach in FinTech mobile application development. It equips businesses with the tools to deliver seamless, secure, and efficient financial services, fueling growth and fostering financial inclusion through technology innovation.